Q2 2025 Quarterly Investment Commentary

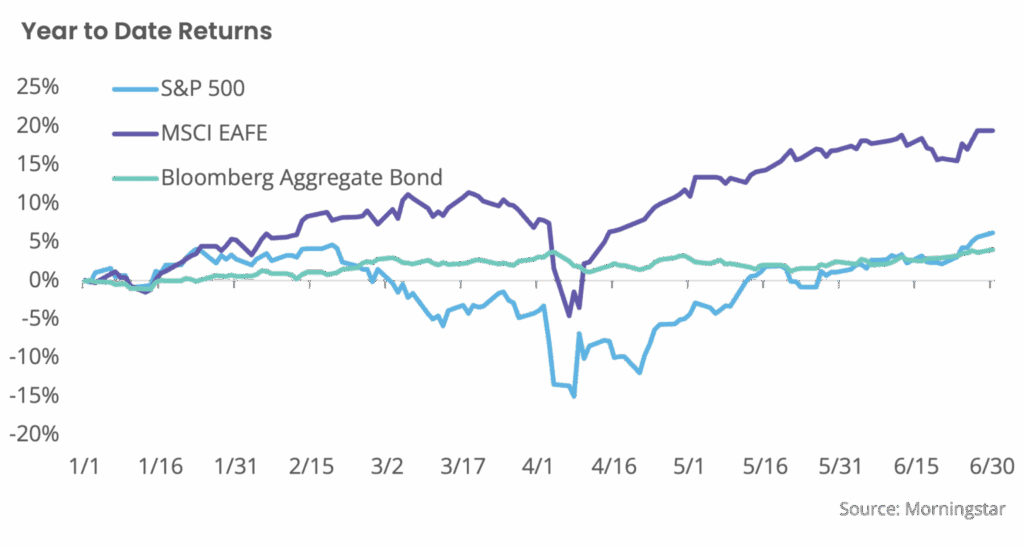

After a rocky start to the second quarter, marked by tariff headlines, shaky consumer confidence, and market volatility, markets ended the quarter much higher than they began.

- The S&P 500 gained 10.9%, fully recovering from April’s dip, and finishing the first half in positive territory.

- Developed international stocks returned 11.8% for the quarter and 19.5% year to date, helped by a weaker dollar and stronger earnings overseas.

- Core bonds exhibited volatility too, as interest rates vacillated, but returns still ended the quarter modestly positive.

Markets advanced despite renewed tensions in the Middle East as Israel and later the U.S. launched attacks on Iran. The quarter reinforced a familiar theme: political shocks make for good headlines but rarely shift market direction over the long run. Investors eventually return their focus to earnings, interest rates, and the health of the economy.

The U.S. Dollar Debate

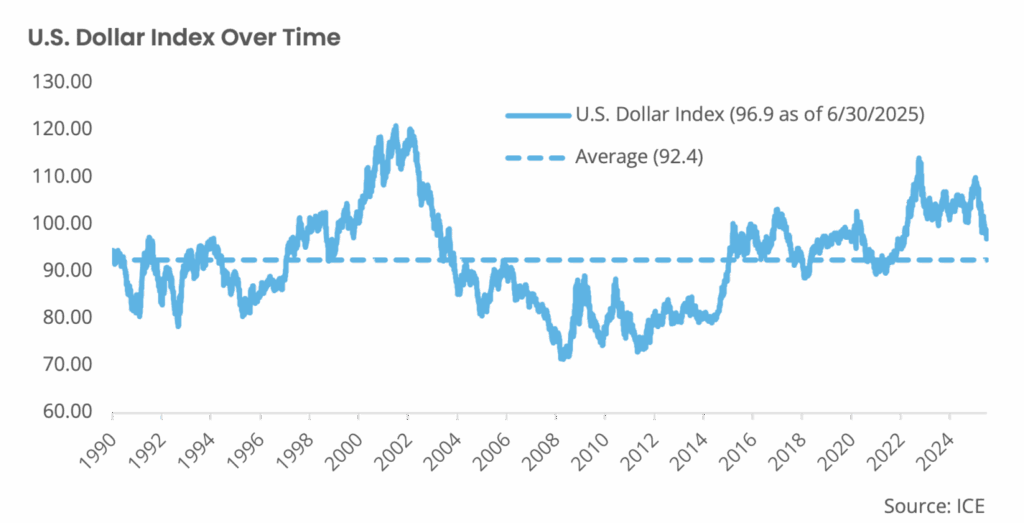

The U.S. dollar drew intense attention this quarter, falling more than 10% year to date. It was the worst first half for the currency in decades. The dollar’s decline was a boon for other currencies, however, creating a tailwind for international equities.

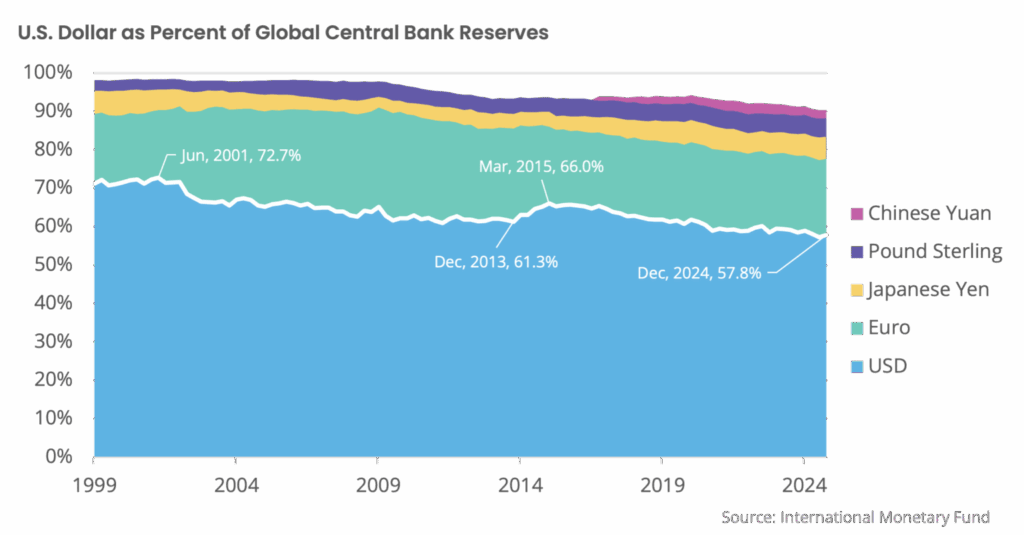

Most of the concerns about the dollar’s future as the reserve currency feels alarmist. The dollar represents about 58% of global central bank reserves, down from more than 70% in 2001, but the rate of decline is slow paced. No other currency comes close to this level of engagement. The euro accounts for less than 20% and the rest are even smaller. We wouldn’t rule out a shift in the global currency order within our lifetime, but the path looks gradual, and the dollar’s entrenched advantages remain formidable.

Beyond central bank holdings, the dollar is embedded into the foundation of the global financial system. It is used in more than 85% of all currency transactions and serves as the foundation for global trade and capital flows.

History shows that exchange rates rarely follow a straight line, and even when a trend appears clear, with hindsight we see that it often reverses quickly. There are past examples of this, like when the dollar weakened throughout the early 2000s and strengthened sharply in the 2010s. It has now started to give back some of those gains. These shifts are driven less by political noise and more by relative growth expectations, interest rate differentials, and capital flows. However, there are also examples of shorter-term declines, similar to what we are experiencing this year, that have quickly reversed course. Investors should resist the urge to draw straight-line projections based on recent moves.

Behaviorally, currency stories often lead to overreaction. Moves in the dollar often feel personal, even political. Calls for the collapse of the dollar tend to promulgate after significant declines, just as headlines about dollar exceptionalism dominate after periods of strength. Usually, the dollar settles somewhere in between these two extremes.

So, how should investors be positioned for potential dollar volatility? We believe the most effective way to gain exposure to currencies is through international equities. Trading currencies directly brings high volatility and a relatively low expected return. But when embedded within foreign equity allocations, they augment portfolio diversification without adding undue risk.

The Broader Story

The overall global economic and earnings outlook is more important to portfolio returns.

- The U.S. economy continues to show signs of resilience, despite weakness in soft data, such as sentiment readings and surveys.

- Globally, we may be reaching an inflection point. In Europe, historically tight fiscal policies are giving way to a greater willingness to invest in defense and infrastructure.

- First-quarter earnings showed higher than expected growth, though we note that valuations increased over the quarter.

Final Thoughts

This quarter’s market action was rewarding to two types of investors: those with diversified portfolios and those able to tune out the noise.

- U.S. stocks rebounded as the focus shifted back to earnings and economic fundamentals.

- International stock returns benefitted from both equity and currency.

- Bonds helped stabilize portfolios despite the equity market swings.

For all the energy spent wondering what comes next, the most valuable reminder may have been the simplest. Sometimes, we must remind ourselves to “don’t just do something, stand there!”